Brand value

Monetary brand valuation

Brand

licensing

Brand

financing

Brand

accounting

What is a brand value?

A brand value quantifies the financial value of a brand. It measures the contribution of a brand to the overall value of a company. A strong brand stands out positively from the competition, achieves higher customer loyalty and thus obtains a higher willingness of customers to pay price premiums.

Looking at the yearly published brand value rankings, it strikes that the brand values of Apple & Co. are drifting apart by billions. Does this mean that the valuation of brands is just a guessing game? By no means! The value of a brand develops in the „heart and minds“ of the target group and can be determined monetarily in an objective and resilient way.

But how does this work? Each of us generates value for brands on a daily basis. We buy products and services for a given price that we are willing to pay – when purchasing at the supermarket as well as when deciding on investments in a professional environment.

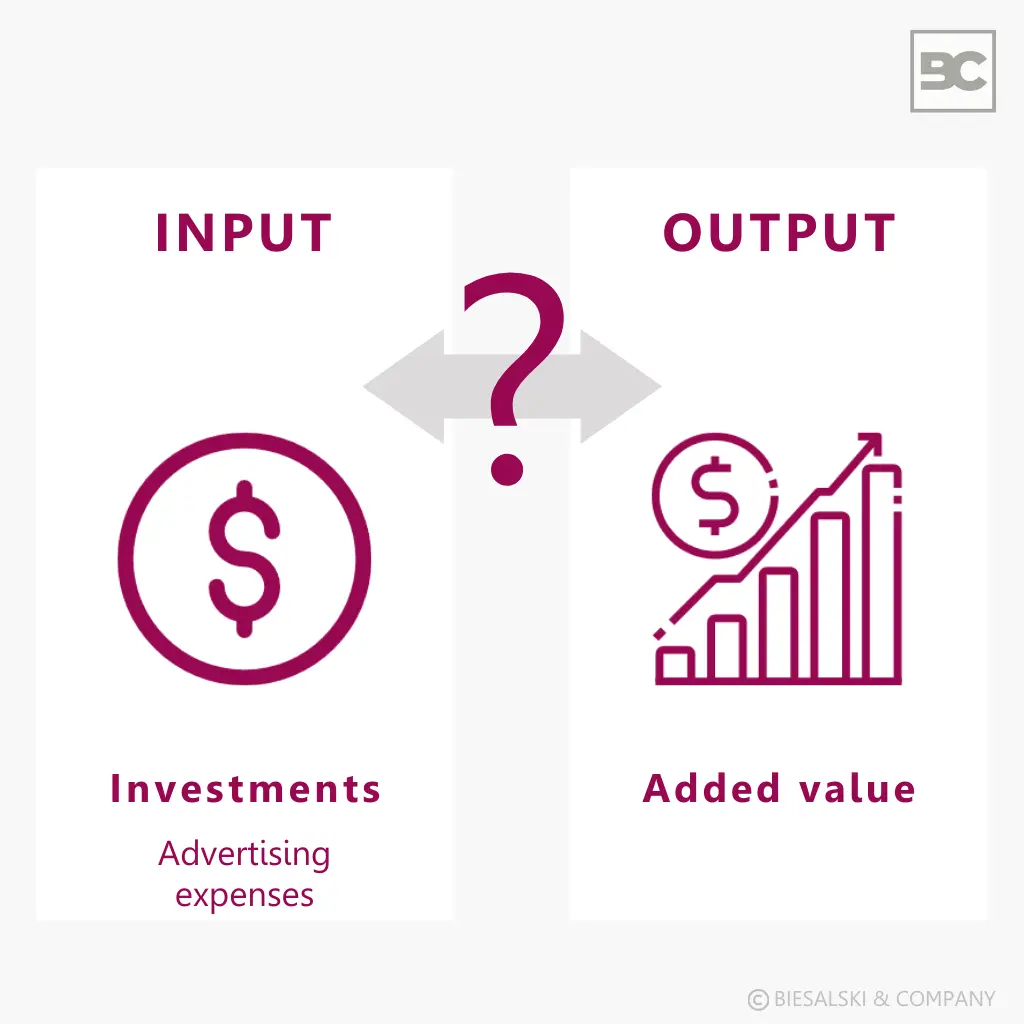

The brand value chain explains how the brand value comes about – from investments in marketing mix to perception, attitude and behaviour of the target group up to brand value creation. This does not only make the brand value measurable, but at the same time selectively controllable and useable.

Against the background of the following areas of application, we have performed a variety of monetary brand valuations for our customers:

Therefore: brands can be more than just a security!

How is brand value created?

The creation of brand value follows the behavioural science approach to explaining buyer behaviour. First, the brand must attract attention. This is ensured by the company’s communication. The aim of communication is on the one hand to ensure brand awareness and on the other hand to convey an image for the brand. A positive perception of the brand’s image by the target group leads to a long-term positive attitude towards the brand – in the form of identification, likeability, confidence and loyalty. A positive attitude then leads to a positive behavioural intention – in which the brand is considered in the purchase decision process, or perhaps even represents the first choice. The positive experience with the brand leads to purchase, repeat purchase, recommendation and/or an increased willingness to pay.

How is a brand value determined?

The approaches for determining the brand value are based on the methods for determining the company value. Thus, a basic distinction is made between market-, cost- or capital value-oriented methods. According to the IDW (Institute of Public Auditors in Germany), the capital value-oriented methods are preferable. Within the capital value-oriented methods, all methods can be considered in principle, depending on the importance of the brand for a company and the availability of information. According to the IDW, the “theoretically” preferable method is the multiple profit method.

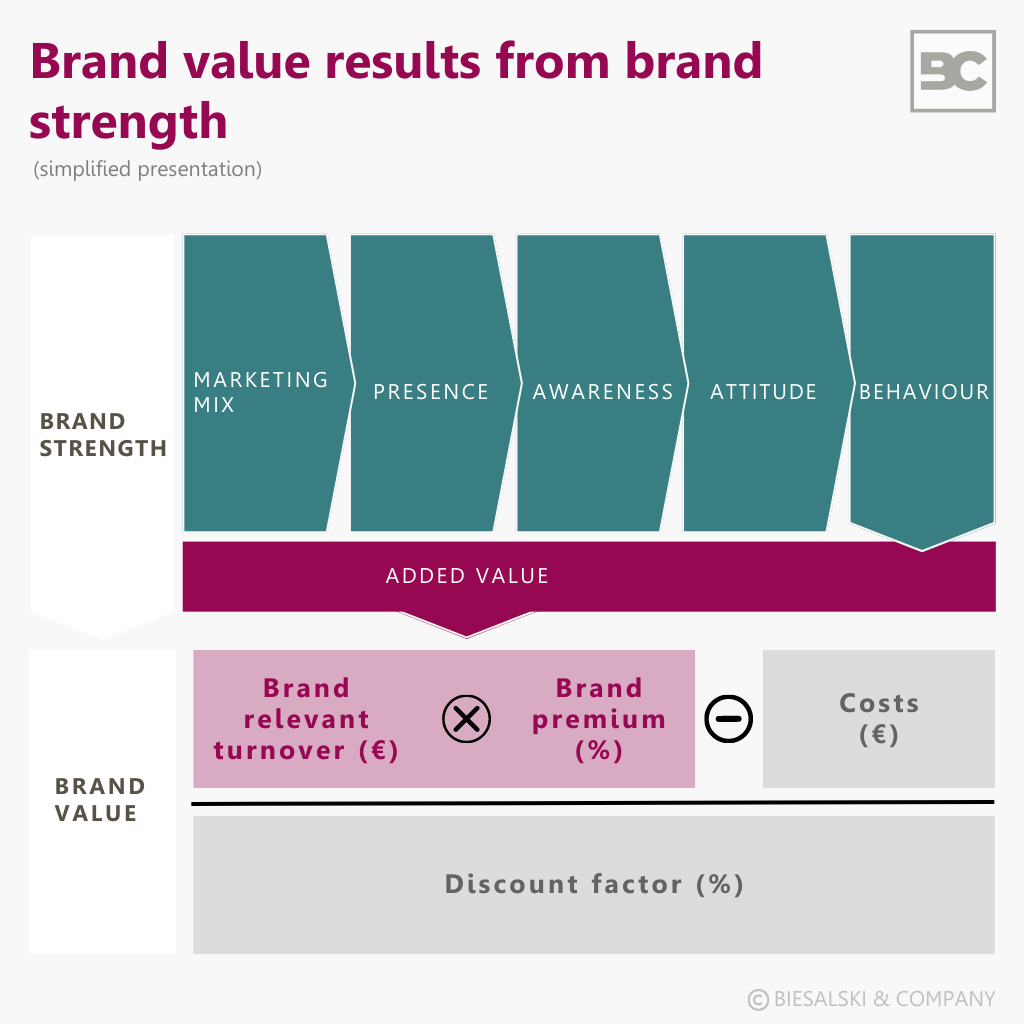

In the capital value-oriented methods, the value of the brand results from the sum of the present values of the future cash flows achievable through the brand on the valuation date (discounted cash flow). The central task of the valuation is to isolate the brand-specific cash flows. In the preferred incremental profit method, the accrual of brand-relevant earnings is carried out with the help of the higher prices and/or higher saleable quantities attributable to the brand.

The price/volume premium is determined by comparing the branded product with the lowest priced product that is comparable in quality and scope of services. The determination of price/volume premiums is based on market analyses and/or behavioural science methods.

What does the brand value say?

The balance sheet value of a company and its market capitalisation are often very different. While all tangible assets are reflected in the balance sheet value, the company also has “hidden reserves” that make the company more valuable from the shareholder’s point of view. These “hidden reserves”, which are not reflected in the balance sheet of the company, include intangible assets such as brands, patents, customer relationships, employees, etc. The values of these assets are often very high.

With a price-to-book ratio (P/B) of DAX companies (2021) of over 1.8, this means that for almost half of the company’s value there is no transparency about its value substance. The brand value creates clarity and quantifies a relevant share of this goodwill. With the help of the brand value, existing assets of the company are revealed, which can also be used for capitalisation purposes.

Our network of experts for your brand value

Our experts advise you in capitalising the monetary brand value. The different areas of application of brand valuation usually require the interaction of various competencies. Using an appropriate network of lawyers and contract brokers as well as partners from the areas of financing, structuring and audit, we help you with the implementation. Fulfilling the valuation standards IDW S5 and DIN/ISO is self-explanatory for us. In this “orchestra”, security regarding the acceptance of the brand value and the intrinsic value of the brand is created. This way, the ideal solution for your “good name” is realised.